Nevada Information Returns - Form W-2 & 1099

Federal Forms 1098, 1099, W-2, and W-3 are tax documents used for reporting both federal and state tax withholding, though some states require additional forms to be submitted. The Nevada Department of Revenue DOES require additional

forms to be filed.

Every employer is required to file Form W-2 for wages, tips, or any other applicable compensation of $600

or more that either:

- Income, social security, or Medicare tax was withheld

- Non-resident contractors (for contracts exceeding $10,000.00)

- Income, social security, or Medicare tax would have been withheld if the employee had claimed no more than one withholding allowance or exemption from withholding on Form W-4.

The Form 1099 Series for ExpressTaxFilings consists of Forms 1099-INT, 1099-MISC, and 1099-DIV. This series of forms is used to report various types of “Other Income” not including wages, salaries, and tips. Forms 1099 are typically used when the taxpayer has received income from sources other than a wage-paying job. There are eleven different variations to Form 1099, depending on the type of income being reported will determine which form you will need to use. The state of Louisiana requires filing for the following forms:

| Forms | Due Dates | Notes | |

|---|---|---|---|

| Paper Filing | E-Filing | ||

| 1099-MISC Miscellaneous Income | January 31st | January 31st | Form 1099-MISC is for reporting miscellaneous income for service performed for a business by people not treated as its employees, such as payments to subcontractors, rent payments, or prizes. |

| 1099-R | January 31st | January 31st | Form 1099-R is for reporting distributions from pensions, annuities, IRAs, or any other applicable retirement or profit-sharing plans. |

| 1099-DIV Dividends and Distributions | January 31st | January 31st | Form 1099-DIV is a yearly tax statement provided to investors by banks and other financial institutions to report dividends and other distributions. |

| W-2 | January 31st | January 31st | Form W-2 is a summarization of an individual employee’s wages, tips, any other applicable compensation, or taxes withheld. |

| W-2G | January 31st | January 31st | Form W-2G is a summarization of a recipient’s certain gambling winnings, such as races, sweepstakes, and lotteries. |

Who Must Withhold Louisiana Income Tax?

Every employer who meets both requirements “A” and “B” below is required to withhold Louisiana

income taxes:

Pays wages to:

- A Louisiana resident (regardless of where the services were performed)

-

A nonresident (persons domiciled outside of Nevada) for services performed in Nevada, unless:

- The employer is an interstate rail or motor carrier, subject to the jurisdiction of the Federal Interstate Commerce Commission and the employee regularly performs duties in two

or more states - The payment is for retirement, pension, or profit-sharing benefits received after retirement

- The employee is a resident of a state with which Nevada has a reciprocity agreement (Illinois, Nevada, Nevada, and Michigan)

- The employer is an interstate rail or motor carrier, subject to the jurisdiction of the Federal Interstate Commerce Commission and the employee regularly performs duties in two

The employer meets any of the following:

- Is engaged in business in Nevada

- Is licensed to do business in Nevada

- Transacts business in Nevada

- Is organized under Nevada law

- Is primarily engaged in business outside of Nevada and is licensed to do business in Nevada or transacts business in Nevada

Who Must File?

Anyone withholding Nevada income tax must file with Nevada along with the Social Security Administration. Every employer who is required to withhold Nevada income tax must register with the Nevada Department of Revenue for a Nevada withholding account number.

Employers are considered exempt from registering for a withholding account number if they meet BOTH the following requirements:

- They pay wages that are exempt from Nevada withholding (i.e., agricultural, domestic)

- They have no Nevada withholding to report (required or voluntary) from wages or other

payments made

Employers may apply for a Nevada withholding tax number by completing an online application at https://tap.revenue.wi.gov/btr. Or by completing Form BTR-101, Application for Business Tax Registration.

Quarterly, monthly, and semi-monthly filers with an active Nevada withholding account must file an electronic deposit report even if no tax was withheld during the period covered.

Electronic filing options include:

- Nevada “My Tax Account”

- Telefile

- ACH Credit

- WT-6 file transmission

The due date for filing WT-6, is on or before the last day of the month following the monthly or quarterly withholding period.

Semi-monthly filers may file one of two ways:

- When the employee pay date is on or between the first (1st) and the 15th of the month, the amount of Nevada income tax withheld from the wages paid is due on or before the last

day of the month - When the employee pay date is on or between the 16th of the month and the last day of the month, the amount of Nevada income tax withheld from the wages paid is due on or before the 15th of the following month.

What and Where to File?

Those employers required to file with the Nevada Department of Revenue must file Nevada Form WT-7, Employer’s Annual Reconciliation of Nevada Income Tax Withheld From Wages, along with all applicable W-2s, W-2Gs and 1099s. Even if the filer submitted all applicable forms electronically, they still need to file a paper WT-7. If the employer is an annual filer, payment should be included with Form WT-7. Employers filing 50 or more withholding statements are require to file Forms W-2 electronically using one of the following:

- PDF file from the Social Security Administration’s website and then transmitting the file through

DOR’s website - Using their Nevada “My Tax Account” account to submit forms (Filers will need to use another method to meet federal W-2 reporting requirements)

- Submitting an EFW2 text file through DOR’s website http://www.revenue.wi.gov/eserv/w-2.html

Those employers filing fewer than 50 withholding statements may file using the above methods or by mailing in their applicable forms to:

If a refund or tax is due:

Nevada Department of Revenue

P.O. Box 8981,

Madison, WI 53708-8981.

If no tax is due:

Nevada Department of Revenue

P.O. Box 8920,

Madison, WI 53708-8920.

Due Date

The due date to file Form WT-7, along with all applicable forms, is January 31st in the following year of the year in which the form is in reference to, both to Nevada and all

applicable employees.

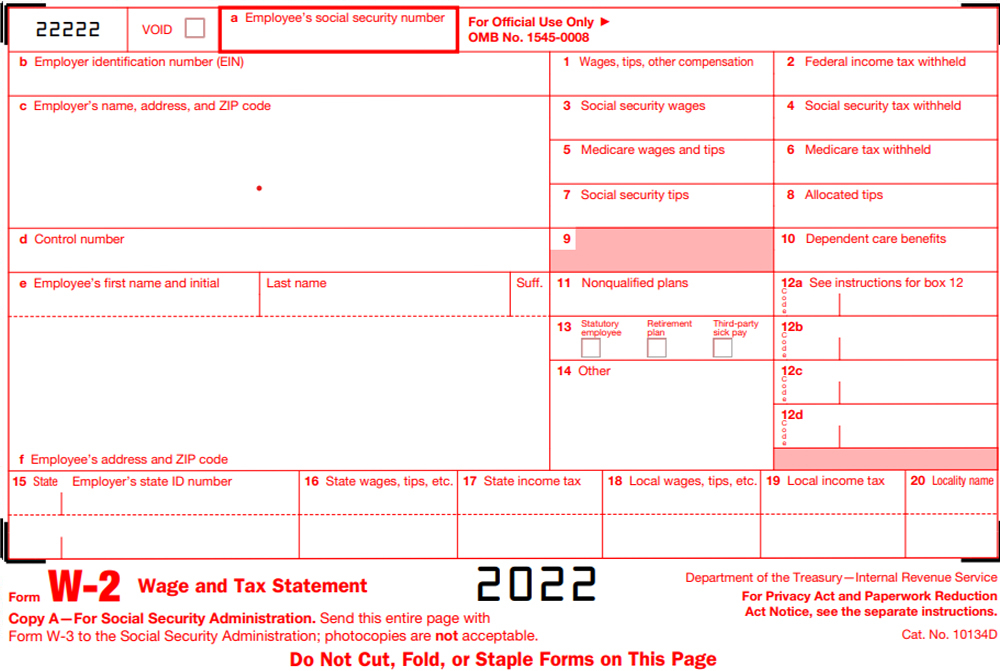

Information Returns - IRS Form W-2

Form W-2, Wage and Tax Statement, is used to report wages paid to employees and the taxes

withheld from them.

Every employer engaged in a trade or business who pays compensation for services performed by an employee, including non-cash payments of $600 or more for the year, must file a Form W-2 for each employee (even if the employee is related to the employer) from whom:

- Income, social security, or Medicare tax was withheld

- Income tax would have been withheld if the employee had claimed no more than one withholding allowance or had not claimed exemption from withholding on

Form W-4

Those filers required to file W-2s with the state of Nevada MUST file Nevada Form WT-7, Employer’s Annual Reconciliation of Nevada Income Tax Withheld From Wages.

State Link :

http://www.revenue.wi.gov/withholding/index.html

IRS /SSA LINKS :

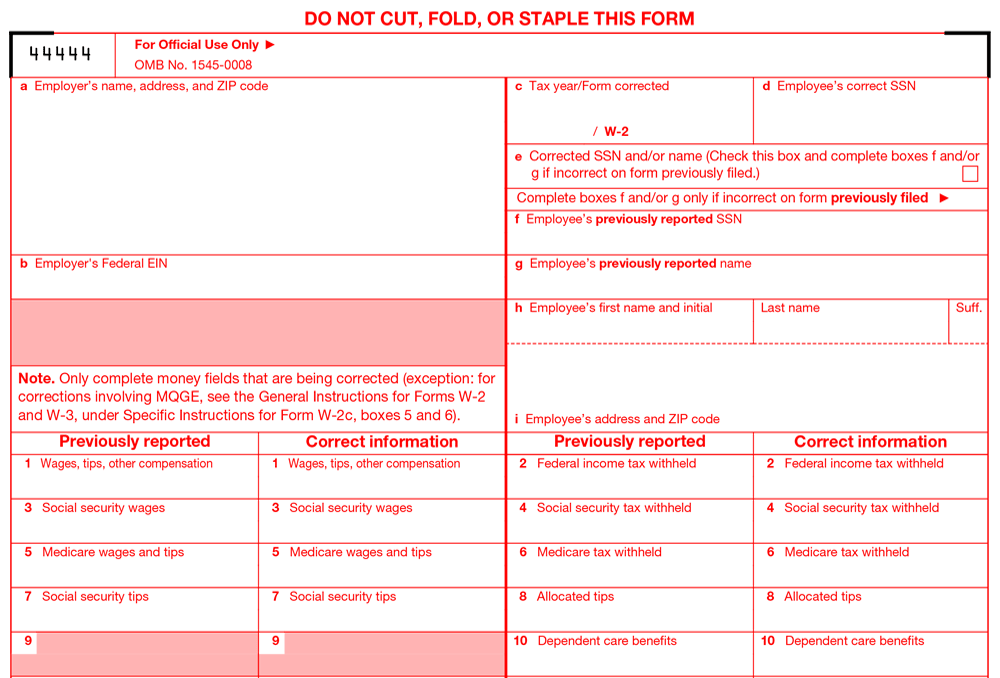

Form W-2C

Form W-2c is for correcting any errors entered in Form W-2. Filers may use Express Tax Filings to easily edit and fix any incorrect W-2s originally filed with Express. If the filer submitted Form W-2 through ExpressTaxFilings and the return was accepted by the IRS, they can make corrections of that form by going to ‘Submitted Forms’ on the dashboard, choose the correct form and click ‘Make Corrections’ under Options.

The filer will then select the Payer and the form that needs to be corrected. This will open a Form W-2 C, where they will be able to update the correct information. Correct errors (such as incorrect name, SSN, or amount) on a previously filed Form

W-2 or Form W-2c. If they are correcting only an employee's name and/or SSN, complete Form W-2c boxes d through i. Do not complete boxes 1 through 20. Have the employee correct the SSN and/or name on his or her original Form W-2. If the employee has been given a new social security card following an adjustment to his or her resident status that shows a different name or SSN, file a Form W-2c for the most current year only.

In order to correct an incorrect tax year and/or EIN on a previously submitted Form W-2, enter the tax year and EIN originally reported, and enter in the “Previously reported” boxes the money amounts that were on the original Form W-2. In the “Correct information” boxes, enter zeros. Prepare a second Form W-2C and enter zeros in the “Previously reported” boxes, and enter the correct money amounts in the “Correct information” boxes.

Enter the correct tax year and/or correct EIN. If the filer submitted a Form W-2 with the SSA that reported an incorrect address for the employee, but all other information on the Form W-2 was correct, the filer will not file Form W-2c with the SSA just to correct the address. But, if the address was incorrect on the Form W-2 they provided to the employee, the filer must do one of the following:

- Issue a corrected Form W-2 to the employee with the new address. Indicate “REISSUED STATEMENT” on the new copies. Do not send Copy A of Form W-2 to the SSA.

- Issue a Form W-2c to the employee that shows the correct address in box i, and all other correct information. Do not send Copy A of Form W-2c to the SSA. Reissue the Form W-2 that had the incorrect address to the employee in an envelope showing the correct address.

Form W-3

Form W-3 is a reconciliation form used to summarize all wages and withholdings, as well as any other applicable information. This form includes the total amount for all employees that worked for the employer during

the tax year.

Anyone who paper filed Form W-2 must file Form W-3 to send with Copy A of Forms W-2 to the SSA. Even if there is only one paper W-2 form being filed a W-3 is still required. Do not file a W-3 for Form(s) W-2 that were submitted electronically to the SSA. A transmitter or sender may sign Form W-3 (or use their PIN to e-file) for the employer or payer only if the sender is authorized to sign by an agency agreement (whether oral, written, or implied) that is valid under state law; and it reads “For (name of payer)” next to the signature. (This applies to paper filing of Form W-3 only).

To correct a W-3 the filer can use the current version of Form W-3c to correct errors. Corrections may be made from an error on a previously filed Form W-3 or Form W-3c. They must file Copy A of Form W-3c with the SSA.

Corrections reported on Form W-2c may require the filer to make corrections to their previously filed employment tax returns using the corresponding “X” form, such as Form 941-X, Adjusted Employer's QUARTERLY Federal Tax Return or Claim for Refund; Form 943-X, Adjusted Employer's Annual Federal Tax Return for Agricultural Employees or Claim for Refund; Form 944-X, Adjusted Employer's ANNUAL Federal Tax Return or Claim for Refund; or Form CT-1X, Adjusted Employer's Annual Railroad Retirement Tax Return or

Claim for Refund.

Form W-3 is NOT required when e-filing Forms W-2 or 1099. Additionally, Form W-3 is not required when filing W-2s with Nevada. Instead, the filer will submit Nevada Form WT-7

Information Returns - IRS Form 1099

A form 1099 is used to report a variety of unique income payment types to the IRS. This form is typically used when the taxpayer has received income from sources other than a wage-paying job. There are several different variations to the 1099 forms themselves. The specific 1099 form is determined depending on the type of income being reported.

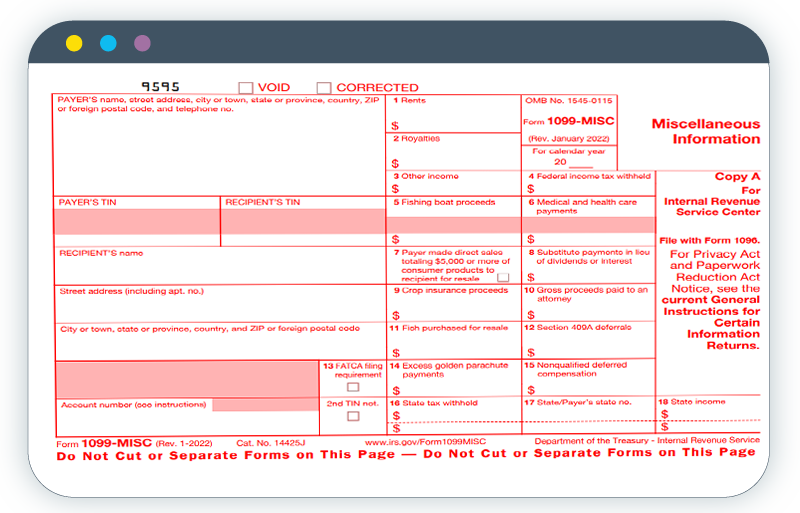

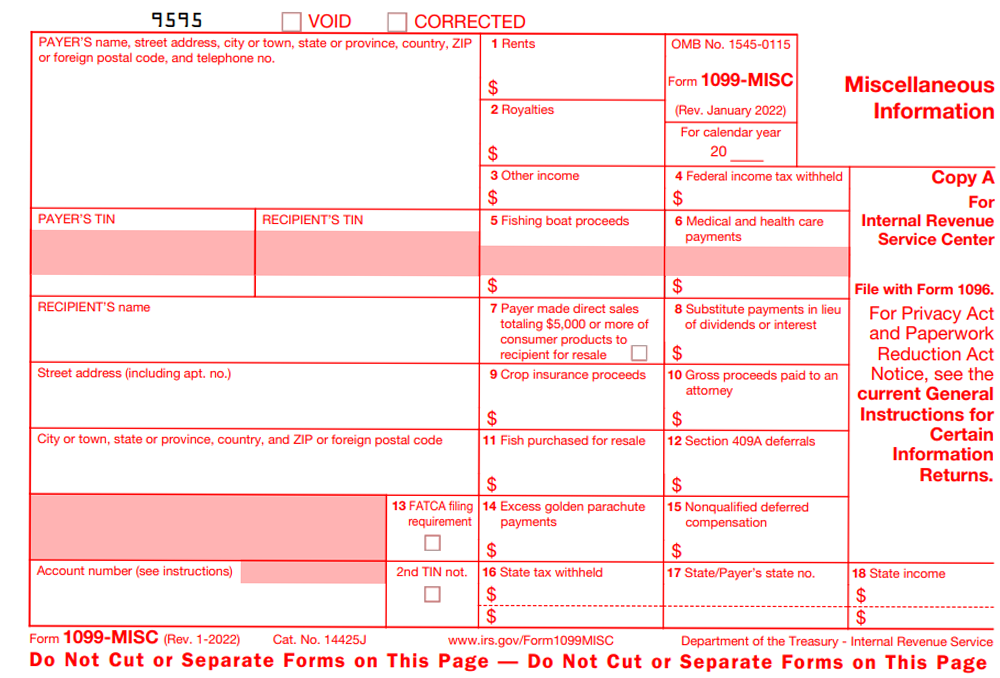

Form 1099 MISC

Form 1099-MISC is one of the many types of 1099 forms. This form is typically only for payments made in the course of your trade or business. Even non-profit organizations are considered to be engaged in a trade or business and are subject to these reporting requirements.

Form 1099-MISC, Miscellaneous Income, is used to report payments for services performed for a business by people not treated as its employees, such as payments to subcontractors, rent payments or prizes.

A 1099-MISC form must be provided to the recipient and a copy mailed to or E-Filed with the IRS.

This form is for Miscellaneous Income filed for each person to whom a payer paid during the year:

- At least $10 in royalties or broker payments in lieu of dividends or tax-exempt interest;

- At least $600 in rents, services (including parts and materials), prizes and awards, other income payments, medical and health care payments, crop insurance proceeds, cash payments for fish (or other aquatic life) you purchase from anyone engaged in the trade or business of catching fish, or, generally, the cash paid from a notional principal contract to an individual, partnership, or estate;

- Any fishing boat proceeds; or

- Gross proceeds of $600 or more paid to an attorney.

You must also file a form 1099-MISC if direct sales of at least $5,000 of consumer products was sold to a buyer for resale that will be sold anywhere other than a permanent retail establishment.

There are some payments that do not have to be reported on Form 1099-MISC, although they may be taxable to the person receiving the payment. Some of the common exceptions are many payments to corporations, payments made to real estate agents, business travel allowances paid to employees and payments to a tax-exempt organization including tax-exempt trusts.

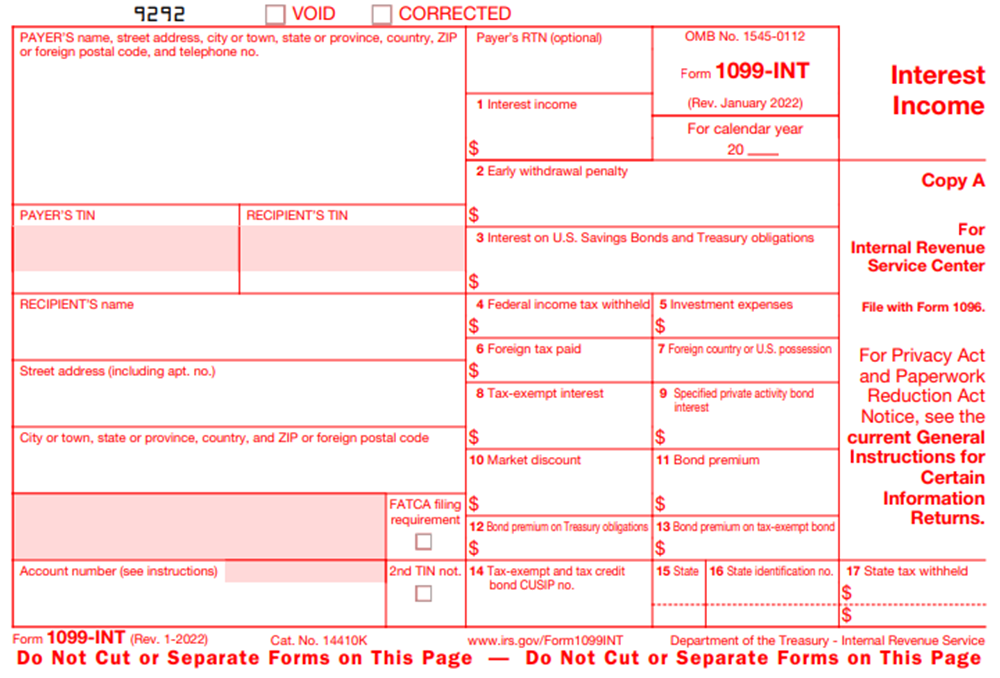

Form 1099 INT

Form 1099-INT is a yearly tax statement provided by payers of interest income. This 1099 form summarizes income of more than $10 from interest along with associated expenses. The information on Form 1099-INT is provided to both the payee and the IRS. Form 1099-INT is used to report interest income for each person:

- To whom you paid amounts reportable in boxes 1, 3 and 8 of at least $10 (or at least $600 of interest paid in the course of your trade or business described in the instructions for Box 1. Interest Income).

- For whom you withheld and paid any foreign tax on interest, or

- From whom you withheld (and did not refund) any federal income tax under the backup withholding rules regardless of the amount of the payment.

Report only interest payments made in the course of your trade or business including federal, state, and local government agencies and activities deemed nonprofit, or for which you were a nominee/middleman. Report tax-exempt interest, only on Form 1099-INT. Do not report tax-exempt interest that is original issue discount (OID). Report taxable OID interest on Form 1099-OID.

Payers are not required to file Form 1099-INT for interest on an obligation issued by an individual, interest on amounts from sources outside the United States paid by a non-U.S. payer / non-U.S. middleman, certain portfolio interest, interest on an obligation issued by an international organization and paid by same, payments made to a foreign beneficial owner or foreign payee.

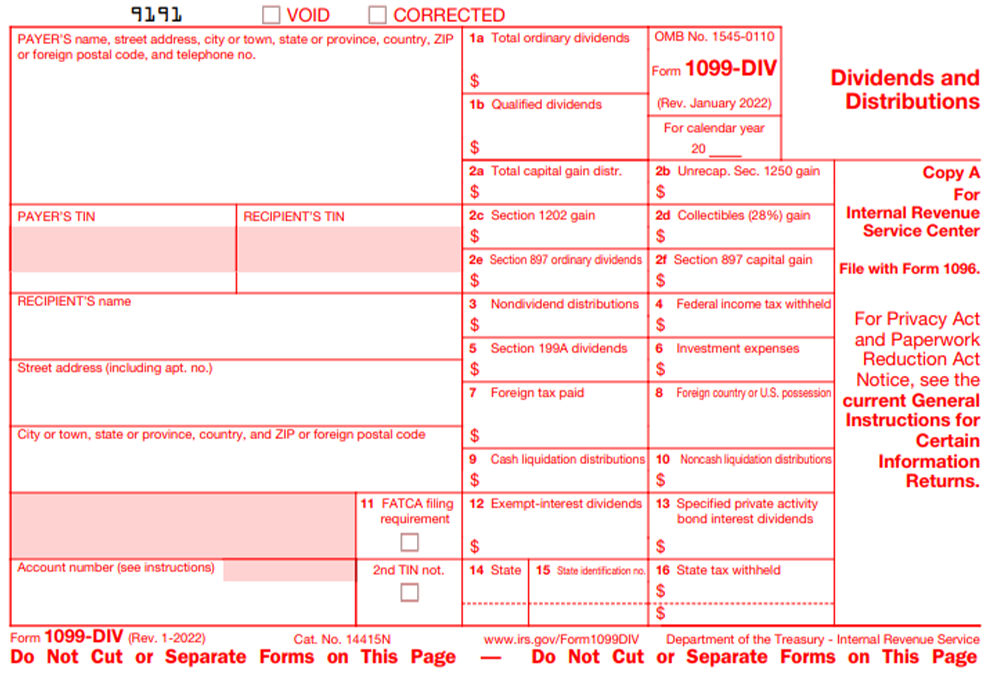

Form 1099 DIV

Form 1099-DIV is a yearly tax statement provided to investors by investment fund companies. This form includes income from dividends including capital gains dividends and exempt-interest dividends over $10. The information on Form 1099-DIV is provided both to the payee and IRS.

Any person that you have paid dividends (including capital gain dividends and exempt-interest dividends) and other distributions on stock of $10 or more,

- For whom you have withheld and paid any foreign tax on dividends and other distributions on stock,

- For whom you have withheld any federal income tax on dividends under the backup withholding rules, or

- To whom you have paid $600 or more as part of a liquidation.

There are 2 Exceptions for the 1099-DIV.

- Taxable dividend distributions from life insurance contracts and employee stock ownership plans are reported on Form 1099-R. This would include Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc.

- Substitute payments in lieu of dividends. For payments received by a broker on behalf of a customer in lieu of dividends as a result of a loan of a customer’s securities, see the instructions for box 8 in the 2012 Instructions for Form 1099-MISC.

Qualified dividends are dividends paid during the tax year from domestic corporations and qualified foreign corporations. For individuals, estates, and trusts, qualified dividends are taxed at a maximum rate of 15% (generally, the rate is zero for individuals whose other income is taxed at the 10% or 15% rate).

Combined Federal/State Filing Program (CFSFP)

The state of Nevada does NOT accept any submissions under the CFSFP with regards to W-2s or 1099s. All applicable forms filed with the Social Security Administration must also be filed with the Nevada Department of Revenue using Form WT-7.

State Resources

Guide to WI Info Returns

Form WT-7

Frequently Asked Questions For Withholdings

Electronic Filing for W-2 (EFW2) Nevada website

Nevada “My Tax Account” website

Nevada Department of Revenue:

P.O. Box 8949

Madison, WI 53708-8949,

Phone: (608) 266-2776.

Fax: (608) 267-1030.

Express Tax Filings

ExpressTaxFilings is a tax E-File software that helps you file and furnish 1099 Forms including 1099-DIV, 1099-MISC, 1099-OID, 1099-INT and W-2 Forms to your recipients all in one place. Our IRS authorized E-File system allows you to file your forms quickly and easily. We are a secured web based service so your 1099 forms and W-2 forms will be available to you at any time from any location. As experienced tax professionals within the industry you can rest assured your Form 1099-DIV and other forms will be E-Filed quickly and simply.

ExpressTaxFilings is a part of the ExpressTaxZone line of IRS Authorized products which also includes Express Extension for E-Filing of Form 7004, Form 4868, Form 8868, ExpressTruckTax for E-Filing of Form 2290, Form 2290 Amendments, Form 8849, Schedule 6 and ExpressIFTA for state IFTA report generation. With Express TaxFilings you can E-File Form 1099-DIV, Form 1099-MISC, Form 1099-INT, Form 1099-OID and Form W-2.

Satrt Now